Atal pension Plan 2023

Different government assistance plans and benefits are given by the focal government for the residents in which the Pradhan Mantri Yojana is executed as a benefits plot for ranchers. In the country different benefits plans are additionally given by the LIC in which the basic annuity plot is exceptionally famous however today we have the Atal Annuity Plan 2022. We should discuss Atal Annuity Yojana 2022, what are the advantages, how to apply, and so forth. Then, at that point, we demand all perusers to peruse the article till the end and offer helpful data to an ever-increasing extent..

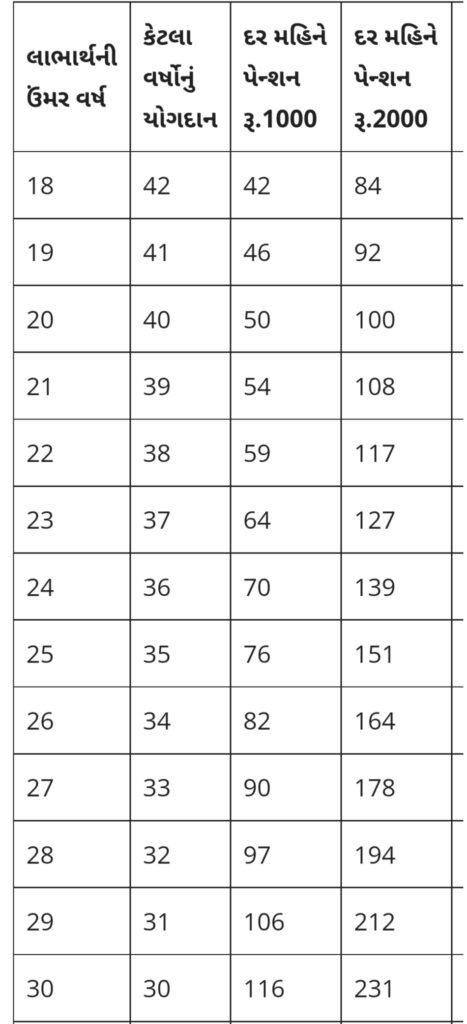

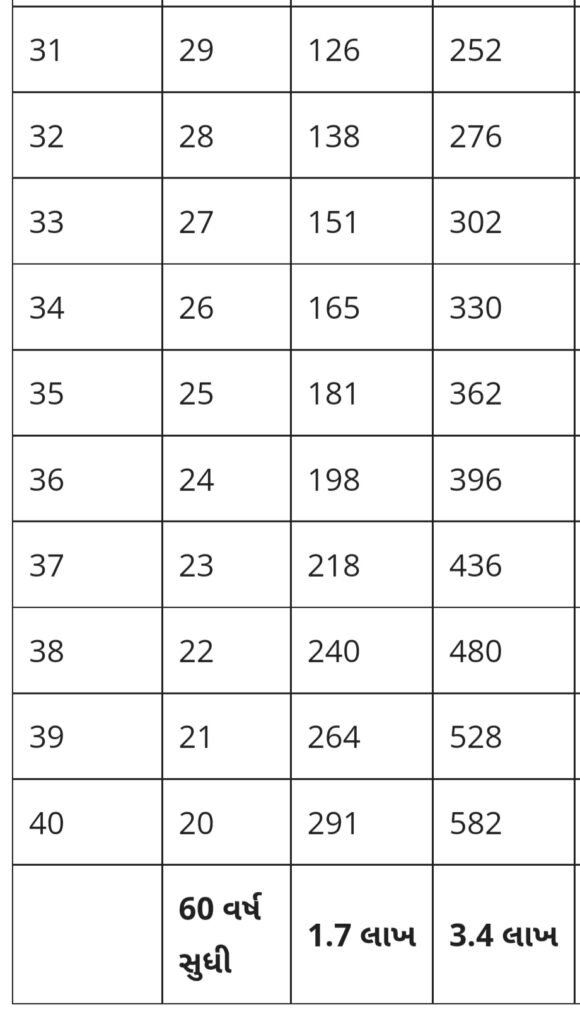

What is Atal Benefits Yojana Atal Benefits Yojana Online Enlistment 2022 Atal Annuity Yojana was sent off by Modi government on first June 2015 This plan covers individuals between 18 to 40 years old On joining this plan you need to store premium sum till 60 years old Residents will be given a month to month benefits of Rs 1,000 to Rs 5,000 after the age of 60. How much benefits relies upon the arrangement you have taken. Your superior will be somewhat higher and the annuity you will get will likewise be bigger.

Reason for Atal Annuity Plan.

Whenever we catch wind of benefits we recall government representatives advanced age annuity handicap benefits however government has begun benefits conspire for youth the base age breaking point to join this plan is 18 years and most extreme age limit is 40 years premium sum upto 60 years old After this you will be given a month to month benefits of least 1,000 to 5,000 in real money in your financial balance..

Atal Annuity Yojana Online Application 2022.

The age bunch for Atal Annuity Yojana is 18 years to 40 years so this plan is exceptionally helpful for any Indian resident who falls inside this age limit. Regularly scheduled installment will be given On the off chance that you are more youthful, you need to save money and assuming you are more seasoned you need to pay more exceptional Measure of premium relies upon age.

Qualification of Atal Annuity Plan.

Certain qualification standards have been set by the Focal Government for profiting the advantage of Atal Benefits Yojana which are as per the following.

Candidate should be a resident of India.

A resident ought to have a bank or post bank account that bank or post record ought to have Aadhaar card and portable connection.

Candidate's age ought to be between 18 years to 40 years.

Just a single individual can partake in this plan who isn't documenting personal expense form i.e individuals who are recording personal expense form can't take part in this plan..

Rundown of archives expected for Atal Benefits Yojana.

✔️aadhar card.

✔️Versatile number.

✔️Distinguishing proof card.

✔️Verification of home.

✔️Account passbook.

✔️Visa size photographs.

Withdrawal from Atal Benefits Plan.

Following are the two methods for pulling out cash under Atal Benefits Yojana through which you can pull out this cash specifically.

On fulfillment of 60 years old On the off chance that the client subsequent to achieving the age of 60 years can pull out from Atal Annuity Yojana and benefit month to month benefits.

On the passing of the arrangement holder In the event that the supporter kicks the bucket because of any explanation, how much the Atal benefits plot goes to his companion or on the other hand in the event that the two of them bite the dust, their chosen people get their sum..

WITHDRAWAL BEFORE AGE OF 60 YEARS IF ANY ONE Have any desire TO Pull out FROM Unavoidable Benefits YOJAN BEFORE Development WE Believe Should SAY HERE THAT WITHDRAWAL FROM Permanent Annuity YOJAN BEFORE 60 Years old Isn't Permitted However In the event of BENEFICIARY'S Passing THE Division Permits WITHDRAWAL OF Irreversible Annuity YOJAN. One of the over two methods is expected to pull out the store.

Online application for Atal Benefits Yojana : HOW TO APPLY FOR ATAL Annuity YOJNA.

To profit the advantages of Atal Annuity Yojana account must be opened in any nationalized bank or mailing station Online record can likewise be opened under Atal Annuity Yojana Record is given beneath for Atal Benefits Yojana sbi online record.

In the wake of signing in Sbi, you need to tap on the administrations in which you need to tap on Government backed retirement Plan.

Presently three choices named PM J BY PM S BY APY will show up in which click on APY Atal Benefits Yojana.

In which the Atal Benefits Yojana online structure will open, presently you need to fill a wide range of subtleties like record number, name, age, address, portable number, and so on..

In which various choices of annuity will be given in which the superior will be concluded in view of the age as per which your record will be opened under Atal Annuity Yojana..

Significant connection

અટલ પેન્શન યોજના ઓફિસિયલ વેબસાઈટ માટે અહીં ક્લિક કરો

Atal Benefits Plan Helpline No .

The helpline number for Atal Annuity Yojana has been declared by the Public authority, in which the residents can contact the complementary number in the event that they have any sort of issue under this plan or on the other hand if they have any desire to find out about this plan..

હેલ્પલાઇન નંબર 1800110001 , 18001001111

No comments:

Post a Comment